Digital printing generally refers to different methods and formats that directly produce a digital-based image. It usually refers to specialized printing where small-run jobs from desktop publishing as well as other digital sources are printed using large printing formats, high-volume laser printers, and inkjet printers.

A significant change has been observed in the printing packaging industry after the introduction of digital printing packaging, which has reduced time and cost compared to conventional printing methods. Digital printing methods offer the benefits of high quality, increased efficiency, and better finishing output for the packaging industry.

According to MarketsandMarkets The global market for digital printing recorded a value of USD 25,521.3 million in 2022 and is projected to reach USD 46,212.9 million by 2029, at a CAGR of 8.92% from 2024 to 2029. It has been growing due to its capacity to produce short print runs economically. Printing on demand helps reduce waste, which ensures that changes in new packaging and graphic designs do not result in unused stock. Significant technological developments in inkjet and electrophotography printing technologies indicate that digital printing is emerging as one of the most cost-effective and easily accessible methods for printing.

-KEY PLAYERS IN DIGITAL PRINTING PACKAGING MARKET ECOSYSTEM

The growth of the printing packaging industry, demand for aesthetic appeal, product differentiation, and technological advancements are some drivers of the digital printing packaging market. An increase in demand for variable data printing is an opportunity for the digital printing packaging market. There is a rise in demand for economical, sustainable, and innovative printing technologies.

Growth of the digital printing packaging market is primarily driven by the following factors:

• Increasing disposable income (GDP)

• Rapid growth of the packaging industry, globally

• Increasing acceptance of digital printing packaging due to cost-efficiency

The digital printing packaging market is dominated by the solvent-based ink segment, which accounted for 49.3% in 2023. This segment is projected to witness the second-highest CAGR of 9.34% to reach USD 23,330.3 million by 2029. Solvent-based inks are suitable for banners, vinyl, wall graphics, trade show graphics, and some fabrics with an inkjet-receptive coating. UV-based inks are also gaining market share as they possess durability, abrasion resistance, and extreme flexibility.

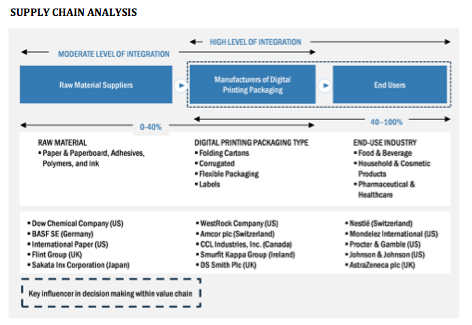

SUPPLY CHAIN ANALYSIS

Thermal transfer printing technology is well established and dominates the overall digital printing packaging market. However, the inkjet and electrophotography segments are projected to grow significantly in the next five years. The inkjet printing segment is projected to reach USD 11,577.9 million by 2029, registering the highest CAGR of 11.47% from 2024 to 2029. Electrophotography and inkjet printing technologies provide both quality and speed improvement. These methods are increasingly replacing traditional offset, flexography, and gravure printing methods. Converters have also started using a colour digital press, along with analogue printing techniques, whereas some converters use electrophotography and inkjet technology.

Variable data printing accounted for the largest share of the digital printing packaging market in 2024. Variable data printing allows elements such as text, graphics, and images to be changed from one printed piece to the next without stopping or slowing down the printing process. Variable data printing helps consumer brands take an innovative and unique approach to their packaging, both with design and consumer engagement.

The digital printing packaging market is projected to be led by the labels segment. The segment is also projected to witness the highest CAGR of 10.04% to reach a market size of USD 33,073.5 billion by 2029 due to stringent labelling requirements driving the use of end-stage modification to print the final details of a package, a common trend in the pharmaceutical industry. Also, factors such as increasing demand for variable data printed labels from the food & beverage sector and growth of other end-use sectors will support the digital printing packaging market over the next five years.

The food & beverage industry dominates the digital printing packaging market. This segment is projected to witness the second-highest CAGR (9.02%), in terms of value during the forecast period. This growth can be attributed to the rapid expansion of this sector worldwide and the need to provide customers with product-related information such as ingredients, shelf life, dosage, and pricing details. The information provided on the packaging plays a significant role in judging a product before a consumer makes a purchase decision.

In 2023, Asia Pacific was the largest market for digital printing packaging, accounting for 38.66% of the global market. Since the region has a growing middle-class population, rising online shopping, increasing manufacturing production, and improved standard of living, there is an increase in demand for convenient packaging, which in turn is propelling the demand for digital printing packaging in this region. China was the leading market for digital printing packaging in Asia Pacific, accounting for a share of 45.35% in terms of value in 2023. The US accounted for the largest share of 82.28% of the North American digital printing packaging market in 2021; it is projected to register a CAGR of 9.67%, in terms of value, between 2024 and 2029. The European market is projected to register a CAGR of 7.83% between 2024 and 2029 in terms of value. Digital printing is quickly outpacing analog however, it’s not totally replacing it. Analog printing is expected to have a growth rate of 0.8% by 2027. Forbes reported that over 60% of survey respondents gravitate towards businesses that are committed to reducing plastics and improving the environment. The print industry generates billions of tons of paper each year and manufacturers that can prove they are committed to limiting their environmental footprint are predicted to win more market share.

www.marketsandmarkets.com